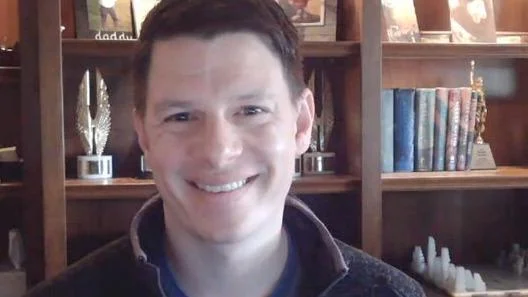

Jeff Swartz CEO at Ohio Business Roundtable | LinkedIn

Jeff Swartz CEO at Ohio Business Roundtable | LinkedIn

As Congress considers the Tax Relief for American Families and Workers Act, the Ohio Business Roundtable has called on Ohio's congressional delegation to back the legislation. The group argues that it contains provisions beneficial to the state's economic development.

"Ultimately, the Tax Relief for American Families and Workers Act is a win for businesses, for families, for communities, and for Ohio," stated Pat Tiberi, President and CEO of the Ohio Business Roundtable.

The act aims to refocus on American businesses by reinstating three significant pro-growth tax policies that have either expired or are being phased out. These include:

1. Full Expensing of Research and Development (R&D) Investments: Since 2022, businesses must expense R&D investments over five years instead of in the year they occur. This change could cost more than 10,000 American jobs annually over the next decade without immediate R&D expensing.

2. Full Expensing of Investments in New Equipment, Machinery, and Technology: Starting in 2023, businesses can only expense 80% of investments in new equipment. This percentage will decrease each year until it is eliminated entirely by 2027. Restoring this policy could create 73,000 American jobs.

3. Limited Interest Deduction on Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA): As of 2022, business interest deductions are limited to 30% of a company's earnings before interest and taxes (EBIT), rather than EBITDA. This change positions the U.S. as an international outlier on business interest deductibility and may result in a loss of 867,000 jobs, $58 billion in wages, and $108 billion in GDP.

In addition to these business policies, the Ohio Business Roundtable supports expanding the child tax credit to help families balance workforce participation with childcare responsibilities.

The proposed tax package also seeks to increase the federal Low-Income Housing Tax Credit. The Ohio Business Roundtable has supported this at the state level due to a housing shortage impacting Ohio's skilled workforce amid recent economic developments.

Alerts Sign-up

Alerts Sign-up