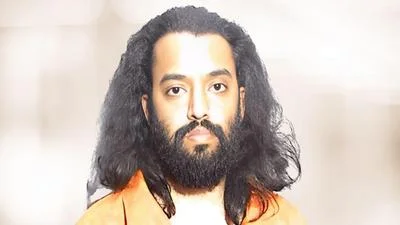

J.D. Vance | Official U.S. Senate headshot

J.D. Vance | Official U.S. Senate headshot

WASHINGTON, D.C. – Senator JD Vance (R-OH) has introduced the Payroll Account Guarantee Act, which would empower community and small regional banks to better compete for depositors with large “too big to fail” financial institutions, which have long received special treatment from federal regulators.

“Regional and community banks all over Ohio are suffering from the unfair advantage held by their larger counterparts,” said Senator Vance. “After the failures of Silicon Valley Bank and Signature Bank, we saw depositors at smaller institutions moving their holdings to larger institutions, benefiting the coastal elite at the expense of the heartland. This expansion of deposit insurance is crucial to ensuring the stability of community and regional banks and the health of the wider U.S. banking system.”

The Payroll Account Guarantee Act would grant unlimited deposit insurance to all non-interest-bearing transaction accounts, which are primarily business payroll and operating accounts. The legislation applies to banks with less than $225 billion in assets and all credit unions, fully guaranteeing all operating, business, and payroll accounts at regional and community banks and credit unions.

Read the legislation here. Read more from The Cleveland Plain Dealer here.

For Background:

- This legislation creates a new, updated, and tailored version of the previous Transaction Account Guarantee Program (TAGP) first instituted by the FDIC during the 2008 financial crisis.

- Unlike the TAGP first instituted by the FDIC, this legislation would not levy fees against participating institutions. It would instead automatically fully guarantee all noninterest-bearing transaction accounts at all banks and credit unions with less than $225 billion in assets, and at all credit unions regardless of assets held.

- Also unlike the initial iteration of TAGP, this legislation would only apply to noninterest-bearing transaction accounts – largely business payroll and operating accounts.

- Financial Times: Large US banks inundated with new depositors as smaller lenders face turmoil

Alerts Sign-up

Alerts Sign-up